Answers

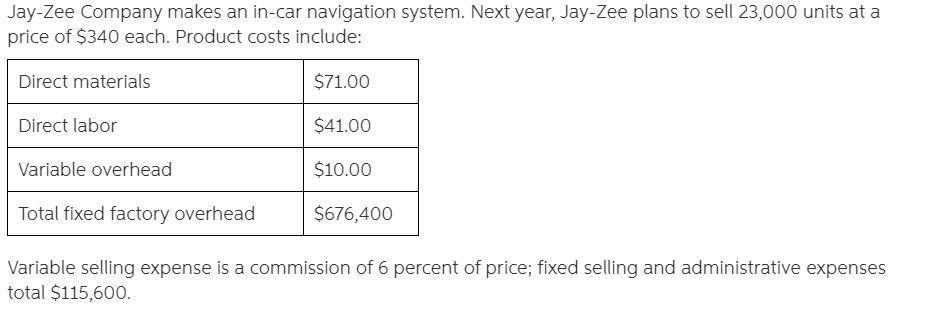

Answer: $20

Explanation:

The sales commission is 6% and the selling price per unit is $340.

The Sales commission per unit saved therefore is;

= 340 * 6%

= $20.40

= $20

Related Questions

Prepare an adjusted trial balance. If an amount

Ledger Accounts, Adjusting Entries, Financial Statements, and Closing Entries; Optional Spreadsheet.

The unadjusted trial balance of Recessive Interiors at January 31, 2019, the end of the year, follows:

Debit Balances Credit Balances

11 Cash 13,100

13 Supplies 8,000

14 Prepaid Insurance 7,500

16 Equipment 113,000

17 Accumulated Depreciation—Equipment 12,000

18 Trucks 90,000

19 Accumulated Depreciation—Trucks 27,100

21 Accounts Payable 4,500

31 Jeanne McQuay, Capital 126,400

32 Jeanne McQuay, Drawing 3,000

41 Service Revenue 155,000

51 Wages Expense 72,000

52 Rent Expense 7,600

53 Truck Expense 5,350

59 Miscellaneous Expense 5,450

325,000 325,000

The following additional accounts from Recessive Interiors' chart of accounts should be used: Wages Payable, 22; Depreciation Expense-Equipment, 54; Supplies Expense, 55; Depreciation Expense-Trucks, 56; Insurance Expense, 57.

The data needed to determine year-end adjustments are as follows:

Supplies on hand at January 31 are $2,850.

Insurance premiums expired during the year are $3,150.

Depreciation of equipment during the year is $5,250.

Depreciation of trucks during the year is $4,000.

Wages accrued but not paid at January 31 are $900.

Required:

Journalize the adjusting entries.

Answers

Answer:

Recessive Interiors

1. Adjusted Trial Balance

As of January 31, 2019:

Debit Credit

11 Cash $13,100

13 Supplies 2,850

14 Prepaid Insurance 4,350

16 Equipment 113,000

17 Acc. Depreciation—Equipment $17,250

18 Trucks 90,000

19 Accumulated Depreciation—Trucks 31,100

21 Accounts Payable 4,500

22 Wages Payable 900

31 Jeanne McQuay, Capital 126,400

32 Jeanne McQuay, Drawing 3,000

41 Service Revenue 155,000

51 Wages Expense 72,900

52 Rent Expense 7,600

53 Truck Expense 5,350

54 Depreciation-Equipment 5,250

55 Supplies Expense 5,150

56 Depreciation-Trucks 4,000

57 Insurance Expense 3,150

59 Miscellaneous Expense 5,450

$335,150 $335,150

2. Adjusting Journal Entries:

Debit 55 Supplies Expense $5,150

Credit 13 Supplies $5,150

To record the supplies expense for the period.

Debit 57 Insurance Expense $3,150

Credit 14 Prepaid Insurance $3,150

To record insurance expense that has expired.

Debit 54 Depreciation Expense - Equipment $5,250

Credit 17 Accumulated Depreciation-Equipment $5,250

To record depreciation expense for the period.

Debit 56 Depreciation Expense - Trucks $4,000

Credit 19 Accumulated Depreciation-Trucks $4,000

To record depreciation expense for the period.

Debit 51 Wages Expense $900

Debit 22 Wages Payable $900

To accrue unpaid wages expenses.

Explanation:

a) Data and Calculations: Unadjusted Adjustments Adjusted

Debit Credit Debit Credit Debit Credit

11 Cash $13,100 $13,100

13 Supplies 8,000 $5,150 2,850

14 Prepaid Insurance 7,500 3,150 4,350

16 Equipment 113,000 113,000

17 Acc. Depreciation—Equipment 12,000 5,250 17,250

18 Trucks 90,000 90,000

19 Accumulated Depreciation—Trucks 27,100 4,000 31,100

21 Accounts Payable 4,500 4,500

22 Wages Payable 900 900

31 Jeanne McQuay, Capital 126,400 126,400

32 Jeanne McQuay, Drawing 3,000 3,000

41 Service Revenue 155,000 155,000

51 Wages Expense 72,000 900 72,900

52 Rent Expense 7,600 7,600

53 Truck Expense 5,350 5,350

54 Depreciation Expense-Equipment 5,250 5,250

55 Supplies Expense 5,150 5,150

56 Depreciation-Trucks 4,000 4,000

57 Insurance Expense 3,150 3,150

59 Miscellaneous Expense 5,450 5,450

325,000 325,000 18,450 18,450

Blight Financial has an investment in bonds issued by Searing Industries that are classified as trading securities. At December 31, Year 2, the Investment in Searing bonds account had a debit balance of $500,000, and the bonds were purchased at par so the $500,000 equals amortized cost. The Fair Value Adjustment account had a debit balance of $20,000. On December 31, Year 3, the amortized cost of those bonds has not changed, but the fair value of those bonds was $515,000. Which of the following will be included in the related journal entry dated December 31, Year 3?

a. Debit to Fair value adjustment for $5,000.

b. Credit to Fair value adjustment for $5,000.

c. Debit to Fair value adjustment for $25,000.

d. Credit to Fair value adjustment for $25,000.

Answers

Answer:

b. Credit to Fair value adjustment for $5,000.

Explanation:

Particulars Amount

Beginning balance of fair value adjustment $20,000

Less: Unrealized gain on Dec 31 $15,000

(515,000 - 500,000)

Credit to fair value adjustment $5,000

The following information is available for two different types of businesses for the Year 1 accounting year. Hopkins CPAs is a service business that provides accounting services to small businesses. Sports Clothing is a merchandising business that sells sports clothing to college students.

Data for Hopkins CPAs

Borrowed $90,000 from the bank to start the business.

Provided $60,000 of services to clients and collected $50,000 cash.

Paid salary expense of $32,000.

Data for Sports Clothing

Borrowed $90,000 from the bank to start the business.

Purchased $60,000 inventory for cash.

Inventory costing $26,000 was sold for $50,000 cash.

Paid $8,000 cash for operating expenses.

Required

Prepare an income statement, balance sheet, and statement of cash flows for each of the companies (Statement of Cash Flows only, items to be deducted must be indicated with a negative amount.)

Answers

Answer:

Please see attached detailed explanation.

Explanation:

Please find attached detailed preparation of income statement, balance sheet and cash flow statement for the above.

Determining the true cash balance, starting with the unadjusted book balance

Nickleson Company had an unadjusted cash balance of $7,176 as of May 31. The company’s bank statement, also dated May 31, included a $67 NSF check written by one of Nickleson’s customers. There were $1,239 in outstanding checks and $255 in deposits in transit as of May 31. According to the bank statement, service charges were $35, and the bank collected an $600 note receivable for Nickleson. The bank statement also showed $14 of interest revenue earned by Nickleson.

Required:

Determine the true cash balance as of May 31. (Hint: It is not necessary to use all of the preceding items to determine the true balance.)

True cash balance

Answers

Answer:

True Cash Balance $7,688

Explanation:

The computation of the true cash balance is shown below:

Unadjusted Cash Balance as of May 31 $7,176

Add: Interest Earned $14

Note Collected by Bank $600

Less: NSF check ($67)

Less Bank charges ($35)

True Cash Balance $7,688

Hence, the true cash balance is $7,688 and the same is to be considered

Del Gato Clinic's cash account shows a $11,589 debit balance and its bank statement shows $10,555 on deposit at the close of business on June 30. Outstanding checks as of June 30 total $1,829. The June 30 bank statement lists a $16 bank service charge. Check No. 919, listed with the canceled checks, was correctly drawn for $467 in payment of a utility bill on June 15. Del Gato Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $476. The June 30 cash receipts of $2,856 were placed in the bank's night depository after banking hours and were not recorded on the June 30 bank statement.

Prepare its bank reconciliation using the above information.

DEL GATO CLINIC

Bank Reconciliation

June 30

Book balance

Add: Bank statement balance

Add:

Deduct: Deduct:

Adjusted bank balance Adjusted book balance

Answers

Answer:

Adjusted bank balance $11,582

Adjusted book balance $11,582

Explanation:

Preparation of bank reconciliation statements

DEL GATO CLINIC Bank Reconciliation

June 30

Bank statement balance $10,555

Add: Bank deposit $2,856

Total $13,411

Deduct: Outstanding checks $1,829

Adjusted bank balance $11,582

DEL GATO CLINIC Bank Reconciliation

June 30

Book balance $11,589

Add: Error in check $9

($467-$476)

Deduct: Bank charges$16

Adjusted book balance $11,582

Therefore Adjusted bank balance will be $11,582 while Adjusted book balance will be $11,582

The adjusted bank balance of $11,582. Adjusted book balance of $11,582.

A financial entity with permission to accept deposits and issue loans is known as a bank. Retail, commercial, and investment banks are just a few of the several sorts of banks. The national government or central bank controls banking in the majority of the world's nations.

Since Italian merchants in the Renaissance formed agreements to borrow and lend money next to a bench, the word bank is derived from the Italian word banco, which means bench. They set the cash down on the bench. Simple financial records have existed since the dawn of time.

Although banks do a variety of tasks, their main responsibility is to collect money from those who have money—known as deposits—pool it, and then lend them to people who need money. Banks act as go-betweens for depositors.

Learn more about the Bank here:

https://brainly.com/question/7275286

#SPJ6

The following income statement items appeared on the adjusted trial balance of Foxworthy Corporation for the year ended December 31, 2021 ($ in 000s): sales revenue, $22,600; cost of goods sold, $14,650; selling expense, $2,330; general and administrative expense, $1,230; dividend revenue from investments, $230; interest expense, $330. Income taxes have not yet been accrued. The company’s income tax rate is 25% on all items of income or loss. These revenue and expense items appear in the company’s income statement every year. The company’s controller, however, has asked for your help in determining the appropriate treatment of the following nonrecurring transactions that also occurred during 2021 ($ in 000s). All transactions are material in amount.

1. Investments were sold during the year at a loss of $300. Foxworthy also had unrealized losses of $200 for the year on investments.

2. One of the company’s factories was closed during the year. Restructuring costs incurred were $2,000.

3. During the year, Foxworthy completed the sale of one of its operating divisions that qualifies as a component of the entity according to GAAP regarding discontinued operations. The division had incurred operating income of $800 in 2016 prior to the sale, and its assets were sold at a

loss of $1,800.

4. Foreign currency translation gains for the year totaled $600.

Required:

Prepare Foxworthy's single, continuous statement of comprehensive income for 2021, including basic earnings per share disclosures. Two million shares of common stock were outstanding throughout the year.

Answers

Question attached

Answer and Explanation:

Please find attached

On January 1, 2021, Marigold Corp. had 461,000 shares of common stock outstanding. During 2021, it had the following transactions that affected the Common Stock account.

February 1 Issued 124,000 shares

March 1 Issued a 10% stock dividend

May 1 Acquired 104,000 shares of treasury stock

June 1 Issued a 3-for-1 stock split

October 1 Reissued 61,000 shares of treasury stock

Required:

Determine the weighted-average number of shares outstanding as of December 31, 2021.

Answers

Answer:

Marigold Corp.

Weighted-average number of shares outstanding as of December 31, 2021:

Date Outstanding Shares Number Weight Weighted

January 1, Beginning 461,000 12/12 461,000

February 1 Issue of new 124,000 11/12 113,667

March 1 Stock dividend 58,500 10/12 48,750

May 1 Treasury stock -104,000 8/12 -69,333

June 1 Issue 3-for-1 split 1,618,500 7/12 944,125

October 1 Reissue of Treasury Stock 61,000 3/12 15,250

Dec. 31 Total Outstanding shares 2,219,000 12 1,513,459

Explanation:

a) Data and Calculations:

Date Outstanding Shares Number

January 1, Beginning 461,000

February 1 Issue of new 124,000

March 1 Stock dividend 58,500 (10% of 461,000 + 124,000)

May 1 Treasury stock -104,000

June 1 Issue 3-for-1 split 1,618,500 (539,500 x 3)

October 1 Reissue of Treasury Stock 61,000

Dec. 31 Total Outstanding shares 2,219,000

b) The months remaining to the end of the year are used to assign weights to the shares.

Simple Random Sampling: The EAI data has information on the annual

incomes of managers and whether they have attended the training

program or not. This data comprise all the 2500 managers that work for

this organization. Using this information, address the following

questions: Select a simple random sample of 150 managers and another

of 250 managers and calculate the point estimates for the population

mean, standard deviation, and proportion. How do the results you

obtained for n = 150 and n = 250 compare to the population

information? Can you make any conclusion out of this? Why and why not?

Please work on excel, show all work including formulas and explain your answers

Answers

Answer:

Hello

Explanation:

make me as brain liest

Crawford Corporation incurred the following transactions:1. Purchased raw materials on account $47,000.2. Raw Materials of $44,200 were requisitioned to the factory. An analysis of the materials requisition slips indicated that $7,300 was classified as indirect materials.3. Factory labor costs incurred were $60,100, of which $51,000 pertained to factory wages payable and $9,100 pertained to employer payroll taxes payable.4. Time tickets indicated that $54,400 was direct labor and $5,700 was indirect labor.5. Manufacturing overhead costs incurred on account were $83,600.6. Depreciation on the company's office building was $8,600.7. Manufacturing overhead was applied at the rate of 160% of direct labor cost.8. Goods costing $94,800 were completed and transferred to finished goods9. Finished goods costing $81,800 to manufacture were sold on account for $110,300.Required:Journalize the above transactions.

Answers

Answer:

Crawford Corporation

General Ledger

1.

Raw Materials $47,000 (debit)

Account Payable $47,000 (credit)

2.

Work In Process : Direct Materials $36,900 (debit)

Work In Process : Indirect Materials $7,300 (debit)

Raw Materials $44,200 (credit)

3.

Work In Process $51,000 (debit)

Salaries Expenses $9,100 (debit)

Salaries Payable $60,100 (credit)

4.

Work In Process : Direct Labor $54,400 (debit)

Work In Process : Indirect Labor $5,700 (debit)

Salaries Expenses $9,100 (debit)

Salaries Payable $60,100 (credit)

5.

Overheads $83,600 (debit)

Accounts Payable $83,600 (credit)

6.

Depreciation Expense - Building $8,600 (debit)

Accumulated Depreciation - Buildings $8,600 (credit)

7.

Work In Process $87,040 (debit)

Overheads $87,040 (credit)

8.

Finished Goods $94,800 (debit)

Work In Process $94,800 (credit)

9.

Accounts Receivable $110,300 (debit)

Cost of Goods Sold $81,800 (debit)

Sales Revenue $110,300 (credit)

Finished Goods $81,800 (credit)

Explanation:

See the Journal entries for Crawford Corporation and their respective transaction number recorded above.

If the amount of credit is 300,000 how much is the discount if the debtor is given a credit term of 2/10 N/30?show your

Answers

Answer:

6,000

Explanation:

In credit sales, 2/10 Net 30 means that the seller has offered the customer a trade discount. 2/10 net 30 is a conditional discount available if payment is made in 10 days. It's a 2% discount should the customer pay in 10 days, if not so, the full amount is due within 30 days.

The discount amount for 300,000 is 2 percent of 300,000.

=2/100 x 300,000

=0.02 x 300,000

=6,000

HELP HELP ILL MASK BRAINLIEST

why do we have different minimum wages ?

Answers

Answer:

Higher minimum wages are most common in states with higher costs of living.

Explanation:

If you live in a smaller town the minimum wage is lower. If you live in a big city it'll more than likely be higher.

Answer:The US has tended to change the national minimum wage infrequently, with changes depending largely on the political balance of power at the federal level. ... But US states and even cities have the power to set minimum wages that are higher than the national rate.

Explanation:

Product Director: We need to pick the best manager for the Prensabi software project. The project involves the latest technology and is very complicated. For example, this project uses a technology called Stage, which is a motion-capture technique that does not require actors to wear specialized gear to record their movements. Since this is a technical project that requires strong technical skills, we should pick the manager with the strongest technical skills. Executive: The manager needs some familiarity with the technology, but he or she won't actually be writing the software code. The bigger challenge here is to analyze the goals of the project and make sure that it is being developed according to a strong overall vision. That's why we should insist that the manager has outstanding conceptual skills. Which of the following, if true, weakens the product director's argument?

a) The project manager with the weakest technical skills also has the weakest human skills

b) The Prensabi project is so large that the project manager for the Prensab project will be unable to take on any other projects until the Prensabi project is inished.

c) The requirements of the Prensabi project are highly unusual.

d) The project manager with the strongest technical skills has no experience with

e) The project manager with the strongest conceptual skills has the weakest technical skills.

Answers

Answer:

The correct answer is: d) The project manager with the strongest technical skills has no experience with

Explanation:

Analyzing the scenario of the question above, it can be considered that the Project manager with the strongest technical skills has no experience with.

This would be the alternative that would weaken the argument of the product director, who says that the biggest challenge is to analyze the objectives of the project and make sure that it is being developed according to a strong overview. That is why we must insist that the manager has excellent conceptual skills.

Conceptual skills are those that allow the manager to have a total view of the organization in a systematic way, where there is experience to manage each part that integrates the organization in an effective way, conceptual skills are a set of knowledge and experiences for the decision making process decision-making is carried out in the best way.

Minion, Inc., has no debt outstanding and a total market value of $211,875. Earnings before interest and taxes, EBIT, are projected to be $14,300 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 20 percent higher. If there is a recession, then EBIT will be 35 percent lower. The company is considering a $33,900 debt issue with an interest rate of 6 percent. The proceeds will be used to repurchase shares of stock. There are currently 7,500 shares outstanding. Assume the company has a tax rate of 21 percent

a-1. Calculate earnings per share, EPS, under each of the three economic scenarios before any debt is issued. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)

a- Calculate the percentage changes in EPS when the economy expands or enters a 2. recession. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to the nearest whole number, e.g., 32.)

b-1.Calculate earnings per share, EPS, under each of the three economic scenarios after the recapitalization. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)

b- Calculate the percentage changes in EPS when the economy expands or enters a 2. recession assuming recapitalization has occurred.

Answers

Answer:

Please see attached.

Explanation:

a. Calculate earnings per share EPS under each of the three economic scenarios

a.2 Calculate the percentage changes in earnings per share EPS for economic expansion, or recession.

b-i calculate economic per share EPS, under each of the three economic scenarios after recapitalisation.

b-2 calculate the percentage changes in EPS when the economy enters or expand a recession assuming no recapitalisation occurred.

Please find attached detailed solution to the above questions.

"The​ ________ includes all international economic transactions with income or payment flows occurring within the year."

Answers

Answer:

Current account

Explanation:

The current account is the account that involves all the transactions deals in an economic way and have international transactions. This shows the income generated and the flows of payment arise within the year or for the present period.

It could be in terms of trading of goods, trading of services, income, present transfers

Therefore the given situation represent the current account

An investor buys a property for $608,000 with a 25-year mortgage and monthly payments at 8.10% APR. After 18 months the investor resells the property for $667,525. How much cash will the investor have from the sale, once the mortgage is paid off

Answers

Answer:

$71,520

Explanation:

we must first determine the monthly payment:

monthly payment = present value / annuity factor

present value = $608,000PV annuity factor, 0.675%, 300 periods = 128.46monthly payment = $608,000 / 128.46 = $4,732.99

Then I prepared an amortization schedule using an excel spreadsheet. After the 18th payment, the principal balance is $596,005.

The investor will have $667,525 - $596,005 = $71,520

Which of the following concepts best describes the supply of housing? A. Irrational B. Inelastic C. Marginal D. Demographic

Answers

Answer: Inelastic

Explanation:

Debby’s Dance Studios is considering the purchase of new sound equipment that will enhance the popularity of its aerobics dancing. The equipment will cost $24,500. Debby is not sure how many members the new equipment will attract, but she estimates that her increased annual cash flows for each of the next five years will have the following probability distribution. Debby’s cost of capital is 13 percent. Use Appendix D for an approximate answer but calculate your final answers using the formula and financial calculator methods.

Cash Flow Probability

$ 3,840 0.4

5,280 0.2

8,110 0.3

10,370 0.1

a. What is the expected value of the cash flow? The value you compute will apply to each of the five years.

Expected Cash Flow $

b. What is the expected net present value? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places. )

Net Present Value $

c. Should Debby buy the new equipment?

Answers

Answer:

Cash Flow Probability Expected value

$3,840 0.4 $1,536

$5,280 0.2 $1,056

$8,110 0.3 $2,433

$10,370 0.1 $1,307

total 1 $6,332

a) the expected value of each yearly cash flow is $6,332

b) the present value of the expected cash flows = $6,332 x 3.5172 (PV annuity factor, 13%, 5 periods) = $22,270.91 ≈ $22,271

the NPV = -$24,500 + $22,271 = -$2,229

c) Debby should not buy the equipment since the project's NPV is negative.

A General Co. bond has a coupon rate of 7 percent and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity

Answers

Answer:

6.81 %

Explanation:

The Required Interest Rate (i) is the yield to maturity and this is calculated as :

Pv = - $1,020.50

pmt = $1,000 × 7% = $70

n = 20

p/yr = 1

Fv = $1,000.00

i = ?

Using a Financial Calculator to input the values as shown, the yield to maturity (i) is 6.8094 or 6.81 %.

A company has total equity of $1,965, net working capital of $175, long-term debt of $940, and current liabilities of $1,770. What is the company's net fixed assets?

Answers

Answer:

The net fixed assets is $2,730

Explanation:

The computation of the net fixed asset is shown below:

= Total equity + long term debt + current liabilities - (net working capital + current liabilities)

= $1,965 + $940 + $1,770 - ($175 + $1,770)

= $2,730

hence, the net fixed assets is $2,730

We simply applied the above formula and the same is to be considered

A _____ has nonprofit status and is owned by its members

A. Securities firm

B. Investment company

C. Savings bank

D. Credit union

Answers

Answer:

D Credit Union

Explanation:

A small country is collecting more money than it spends. What is MOST likely the fiscal policy stance that this government takes?

expansionary stance

contractionary stance

economic stance

neutral stance

Answers

Answer:

Contractionary stance

Explanation:

When the government collects more extra money than it is spending, it signals a robust and fast-growing economy. Contractionary fiscal policy measures are applied to slow down growth and reduce inflationary pressure.

The contractionary fiscal policy is the government's mechanism of reducing the money supply in the economy. The government may reduce its spending in the economy, increase business taxes, or both. These actions decrease the money supply in the economy, which reduces the amount that businesses can borrow to expand. The objective is to lower the aggregate demand, thereby slowing the country's rate of producing new goods and services.

Below is the Retained Earnings account for the year 2020 for Swifty Corp. Retained earnings, January 1, 2020 $261,300 Add:_______.

Gain on sale of investments (net of tax) $44,900

Net income 88,200

Refund on litigation with government, related to the year 2017 (net of tax) 25,300

Recognition of income earned in 2019, but omitted from income statement in that year (net of tax) 29,100 187,500 448,800

Deduct:

Loss on discontinued operations (net of tax) 38,700

Write-off of goodwill (net of tax) 63,700

Cumulative effect on income of prior years in changing from LIFO to FIFO inventory valuation in 2020 (net of tax) 26,900

Cash dividends declared 35,700 165,000

Retained earnings, December 31, 2020 $283,800

Prepare a corrected retained earnings statement. Waterway Corp. normally sells investments of the type mentioned above. FIFO inventory was used in 2020 to compute net income. (List items that increase adjusted retained earnings first.)

Answers

Answer:

Swifty Corp.

Retained Earnings Statement

Retained earnings, January 1, 2020 $261,300

Correction of error from prior period $29,100

Adjustment for change in accounting principle - $26,900

Retained earnings, January, Adjusted $263,500

Add Net Income $56,000

Less Cash dividend -$35,700

Retained earnings, December 31, 2020 $283,800

Workings

Net Income $88,200

+ Gain on sale of investments (net of tax) $44,900

Refund on litigation with government $22,530

$158,400

- Loss on discontinued operation $38,700

Write-off of goodwill $63,700

Net Income $56,000

The following summary transactions occurred during 2021 for Bluebonnet Bakers:

Cash Received from:

Collections from customers $490,000

Interest on notes receivable 11,500

Collection of notes receivable 54,000

Sale of investments 34,000

Issuance of notes payable 175,000

Cash Paid for:

Purchase of inventory 235,000

Interest on notes payable 7,500

Purchase of equipment 90,000

Salaries to employees 95,000

Payment of notes payable 40,000

Dividends to shareholders 35,000

The balance of cash and cash equivalents at the beginning of 2021 was $26,000.

Required:

Prepare a statement of cash flows for 2021 for Bluebonnet Bakers. Use the direct method for reporting operating activities

Answers

Answer and Explanation:

The preparation of the statement of cash flows is presented below:

Bluebonnet Bakers

Cash flow statement

For the year 2021

Cash flow from operating activities

Collections from customers $490,000

Interest on notes receivable 11,500

Less: Interest on notes payable 7,500

Less: Purchase of inventory 235,000

Less: Salaries to employees 95,000

Net cash flow from operating activities $164,000

Cash flow from investing activities

Collection of notes receivable 54,000

Sale of investments 34,000

Less: Purchase of equipment 90,000

Net cash flow from investing activities -$2,000

Cash flow from financing activities

Issuance of notes payable 175,000

Less: Payment of notes payable 40,000

Less: Dividends to shareholders 35,000

Net cash flow from financing activities $100,000

Net increase or decrease in cash $262,000

Add: Opening cash balance $26,000

Ending cash balance $288,000

Consider a second-price, sealed-bid auction with a seller who has one unit of the object which he values at s and two buyers 1, 2 who have values of v1 and v2 for the object. The values s, v1, v2 are all independent, private values. Suppose that both buyers know that the seller will submit his own sealed bid of s (and will keep the item if bid s wins), but they do not know the value of s. The buyers know that the seller must submit his bid before seeing the buyer’s bids and they know that the seller will actually run a second price auction with the three bids he has: his own bid and the two buyer’s bids. Each buyer knows his own value but not the other buyer’s value.

Now suppose that the seller opens the bids from the buyers and then submits his own bid after seeing the bids from the two buyers. The seller runs a second price auction with these bids in the sense that the object is awarded to the highests bidder (one of the two buyers or the seller) and that bidder pays the second highest bid. Now is it optimal for the buyers to bid truthfully; that is, should they each bid their true value? Give a brief explanation for your answer.

Answers

Answer and Explanation:

Given that this is a second price bid auction whereby the second highest bid is the price that the highest bidder pays for the item up for auction sale, so that b1>b2 then b1 gets item for the price of b2.

Truthfulness of true value is the dominant strategy here which means each player should aim to be truthful with their bid regarding their true value regardless of what other bidders are bidding. Therefore truthfulness of value is the optimal strategy with the best payoff for bidders

In its first year of business, Borden Corporation had sales of $2,020,000 and cost of goods sold of $1,210,000. Borden expects returns in the following year to equal 6% of sales. The adjusting entry or entries to record the expected sales returns is (are):

Answers

Answer: Please see answers in explanation column

Explanation:

Accounts title and explanation Debit Credit

Sales returns and allowances $121,200

Sales refund payable $121,200

Calculation

Expected Sales returns and allowances = sales x expected percentage

= 2,020,000 x 6%= $121,200

Accounts title and explanation Debit Credit

Inventory returns estimated $72,600

Cost of goods sold $72,600

Calculation

expected Cost of goods sold = Cost of goods soldx expected percentage

= 1,210,000 x6%=$72,600

On May 31, the Cash account of Teasel had a normal balance of $5,700. During May, the account was debited for a total of $12,900 and credited for a total of $12,200. What was the balance in the Cash account at the beginning of May

Answers

Answer:

$6,400

Explanation:

Cash Account

Debit :

Beginning Balance $5,700

Receipts $12,900

Totals $18,600

Credit :

Payments $12,200

Ending Balance (Balancing figure) $6,400

Totals $18,600

Marc and Michelle are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to an individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2005). Marc and Michelle have a 10-year-old son, Matthew, who lived with them throughout the entire year. Thus, Marc and Michelle are allowed to claim a $2,000 child tax credit for Matthew. They are also able to claim $2,900 in recovery rebate credit ($2,400 for Marc and Michelle and $500 for Matthew). Assume they did not receive the recovery rebate in advance. Marc and Michelle paid $6,000 of expenditures that qualify as itemized deductions and they had a total of $3,500 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules).

A. What is Marc and Michelle’s gross income?

B. What is Marc and Michelle’s adjusted gross income?

C. What is the total amount of Marc and Michelle’s deductions from AGI?

D. What is Marc and Michelle’s taxable income?

E. What is Marc and Michelle’s taxes payable or refund due for the year?

Answers

Answer:

I will use the 2020 tax schedule since recovery rebate credit applies to 2020:

Marc and Michelle's gross income = Marc's and Michelle's salaries + interest from corporate bonds = $64,000 + $12,000 + $500 = $76,500

they should choose the standard deduction since it is higher than their itemized deductions = ($24,400)

contribution to IRA = ($2,500)

alimony payment = ($1,500) the divorce agreement was settled on 2005

Marc and Michelle's taxable income = $48,100

Marc and Michelle's tax liability = $1,975 + [12% x ($48,100 - $19,750)] = $5,377

Interests on municipal bonds is not taxable.

The amount of taxes that they owe = $5,377 - $3,500 (federal tax withholdings) = $1,877

Refundable tax credits:

$2,000 in child tax credit

$2,900 in recovery rebate credit

total = $4,900

taxes payable or refund = tax liability - refundable tax credits = $1,877 - $4,900 = -$3,023.

Marc and Michelle should get a refund for $3,023

Maisie Taft started her own consulting firm, Maisie Consulting, on May 1, 2020. The following transactions occurred during the month of May.

May 1 Maisie invested $7,000 cash in the business.

2 Paid $900 for office rent for the month.

3 Purchased $800 of supplies on account.

5 Paid $125 to advertise in the County News.

9 Received $4,000 cash for services performed.

12 Withdrew $1,000 cash for personal use.

15 Performed $6,400 of services on account.

17 Paid $2,500 for employee salaries.

20 Made a partial payment of $600 for the supplies purchased on account on May 3.

23 Received a cash payment of $4,000 for services performed on account on May 15.

26 Borrowed $5,000 from the bank on a note payable.

29 Purchased equipment for $4,200 on account.

30 Paid $275 for utilities.

Questions:

A. Prepare an income statement for the month of May.

B. Prepare a balance sheet at May 31, 2020.

Answers

Answer:

A. NET INCOME $6,600

B. TOTAL ASSETS $22,000

TOTAL LIABILITIES AND EQUITY $22,000

Explanation:

A. Preparation of income statement for the month of May.

Maisie Taft INCOME STATEMENT for May 2020

Service Revenue $10,400

($4,000 + $6,400)

Less: Expenses

Rent expense ($900)

Advertising expense ($125)

Salaries expense ($2,500)

Utilities expense ($275)

NET INCOME $6,600

Therefore the Net income on the income statement for the month of May 2020 will be $6,600

B. Preparation of balance sheet at May 31, 2020

Maisie Taft BALANCE SHEET at May 31, 2020

ASSETS:

Cash $14,600

Accounts receivable $2,400

Supplies $800

Equipment $4,200

TOTAL ASSETS $22,000

(14,600+2,400+800+4,200)

LIABILITIES:

Accounts payable $4,400

Notes payable $5,000

Total liabilities $9,400

($4,400+$5,000)

EQUITY:

Owner's equity $7,000

Retained earnings $5,600

($6,600 - $1,000)

Total equity $12,600

($7,000+$5,600)

TOTAL LIABILITIES AND EQUITY $22,000

($9,400 + $12,600)

CASH

May 1 Cash $7,000

2 Paid Office rent ($900)

5 Paid to advertise ($125)

9 Cash Received $4,000

12 Cash Withdrew ($1,000)

17 Paid employee salaries ($2,500)

20 Supplies purchased ($600)

23 Cash payment $4,000

26 Note payable $5,000

30 Utilities ($275)

CASH $14,600

ACCOUNT RECEIVABLES

May 15 $6,400

May 23 ($4,000)

ACCOUNT RECEIVABLES $2,400

ACCOUNT PAYABLE

May 3 $800

May 20 ($600)

May 29 $4,200

ACCOUNT PAYABLE $4,400

Therefore the Total asset on the balance sheet at May 31, 2020 will be $22,000 and the Total liabilities and equity on the balance sheet at May 31, 2020 will be $22,000

Definition of economic costs

Darnell lives in Philadelphia and runs a business that sells pianos. In an average year, he receives $842,000 from selling pianos. Of this sales revenue, he must pay the manufacturer a wholesale cost of $452,000; he also pays wages and utility bills totaling $301,000. He owns his showroom; if he chooses to rent it out, he will receive $38,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Darnell does not operate this piano business, he can work as an accountant and receive an annual salary of $48,000 with no additional monetary costs. No other costs are incurred in running this piano business.

Identify each of Darnell's costs in the following table as either an implicit cost or an explicit cost of selling pianos.

Implicit Cost

Explicit Cost

The wholesale cost for the pianos that Darnell pays the manufacturer

The salary Darnell could earn if he worked as an accountant

The wages and utility bills that Darnell pays

The rental income Darnell could receive if he chose to rent out his showroom

Complete the following table by determining Darnell's accounting and economic profit of his piano business.

Profit

(Dollars)

Accounting Profit

Economic Profit

If Darnell's goal is to maximize his economic profit, he( should, should not) stay in the piano business because the economic profit he would earn as an accountant would be $______.

Answers

Answer:

1. I grouped the costs into explicit and implicit costs below

2. accounting profit = 89000

3. economic profit = 3000

4. daniel should stay in the piano business

Explanation:

explicit costs include:

1. The wholesale cost for the pianos that Darnell pays the manufacturer at $452000

2. The wages and utility bills that Darnell pays at $301000

the implicit costs include:

1. The salary Darnell could earn if he worked as an accountant at $48000

2. The rental income Darnell could receive if he chose to rent out his showroom at $38000

accounting profit:

842000-452000-301000

= 89000

economic profit:

842000-452000-301000-48000-38000 = 3,000

as an accountant economic profit:

48000+38000-89000

= -3000

so he should stay in the piano business so that economic profit would be maximized.

Strategic Plan

2016 - 2018

Boutique Build Australia